Instead, set aside some time to sit down with a bank representative and open up a new checking account and get a new account number. This isn’t a great way to go about things for you or your bank. This would mean that you would have to consistently track your spending, look for transactions you didn’t authorize, and call the bank to cancel a check every time. So they could use this information to buy things online without the need to write a check. When someone has access to your checks, they can just continue writing checks to themselves or businesses.Īlso, with your checkbook, they have your account number. Often, the best way to protect yourself for those who have lost their check book is to close out their account and open up an entirely new one. Close Your Current Checking Account And Open A New One This type of service may cost you a fee, but it may be better and more convenient than having to deal with all of the other actions mentioned on this list.īy having a stop payment placed on the missing check numbers, even if those paper checks fall into the wrong hands, they won’t be able to cause you financial harm. Simply have your bank place a stop-payment order on the range of check numbers that are missing. You should have the number of the last check you wrote as it is on your most recent statement.Īnd you should have the next set of checks. In this case, your financial institution may actually be able to stop each check that you don’t physically have. Some people don’t want to have to go through the process of switching accounts and dealing with an account freeze that impacts their ability to pay for day-to-day expenses.

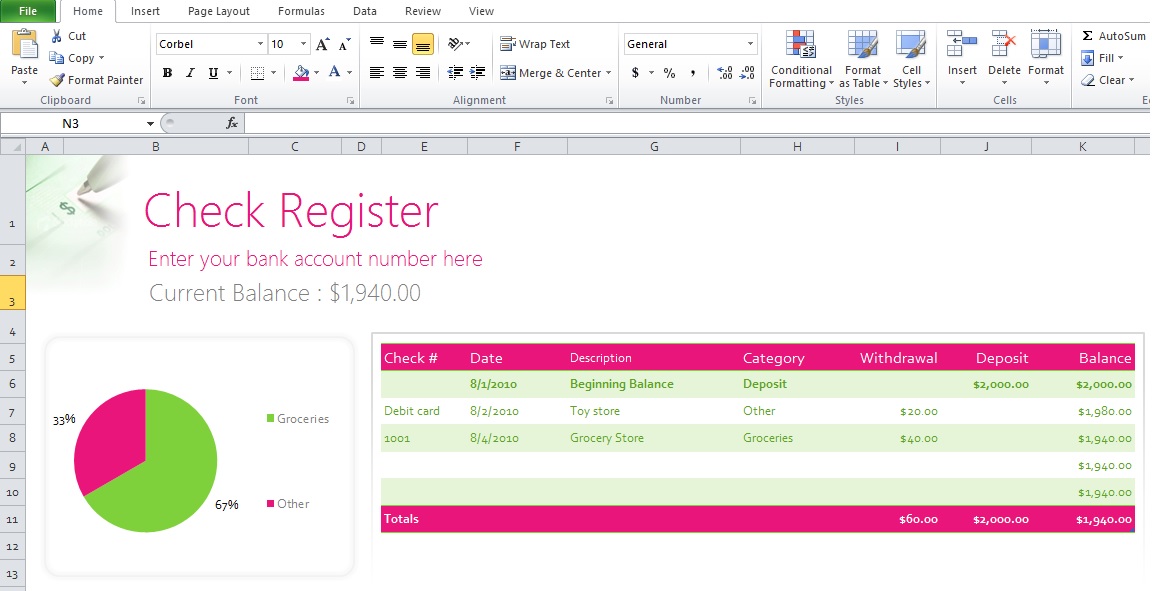

Ask Your Bank To Stop Each Check In Your Checkbook Make sure that you stay on top of your spending so that you’re alerted to these types of transactions immediately. While you may not always be able to reverse old transactions or get your money back, you may still be able to spot transactions that are pending and report those so your money doesn’t leave your account.

Try to determine when you last used your checkbook if you aren’t certain when you lost it.

Tracking your spending is an essential activity, but most people who don’t do this only learn of its importance when it’s too late.Īfter you’ve lost your checkbook, look deeper into your recent bank history to see if there are any financial transactions that you don’t recognize. Check Your Current Transactions For Suspicious Activity If you work to remain calm and think about the last time you used it, you might be able to piece back together where your lost checkbook is.

I MAY HAVE LOST MY CHECKBOOK HOW TO

Read now: Here is how to protect yourself from identity theft.However, making sure that you report the loss will allow the bank to stop any fraudulent transactions from taking place on your account and will give you time to try to find your checkbook. Hopefully, it’s only temporarily lost and not stolen. The moment that you notice your checkbook is lost, reporting it to your bank or credit union so that they can take the necessary actions and freeze your account immediately is the first thing to do. What To Do If I Lost My Checkbook Report A Lost Or Stolen Checkbook Immediately

I MAY HAVE LOST MY CHECKBOOK FREE

Order A Free Copy Of Your Credit Report.Close Your Current Checking Account And Open A New One.Ask Your Bank To Stop Each Check In Your Checkbook.Check Your Current Transactions For Suspicious Activity.Report A Lost Or Stolen Checkbook Immediately.How Much Money Do You Need For Retirement.7 Investing Steps That Will Make You Wealthy.Free Build Wealth Boot Camp Email Course.

0 kommentar(er)

0 kommentar(er)